Fique off-line com o app Player FM !

Episode 305: The Reduced Paid Up Strategy

Manage episode 370430947 series 1610796

In this episode, we ask:

- What is better than a five star review?

- Who needs to hear this?

- Would you like a FREE book? Email us at hello@nyafinancialpodcast.com!

- What about the Apollo missions?

- When will premiums come to an end?

- Would you like to hear Episode 293?

- What about the contractual obligation of the life insurance company?

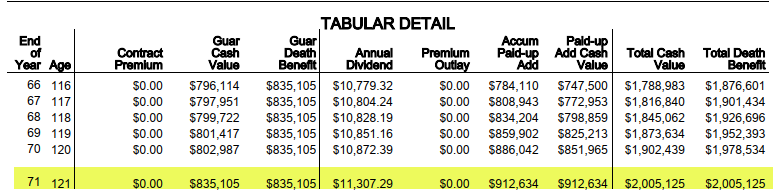

- What is a maturity date?

- What limits exist?

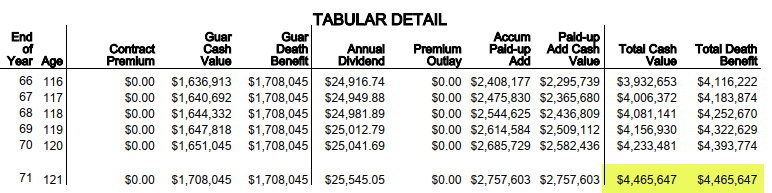

- What about age 121?

- What about actuarial math?

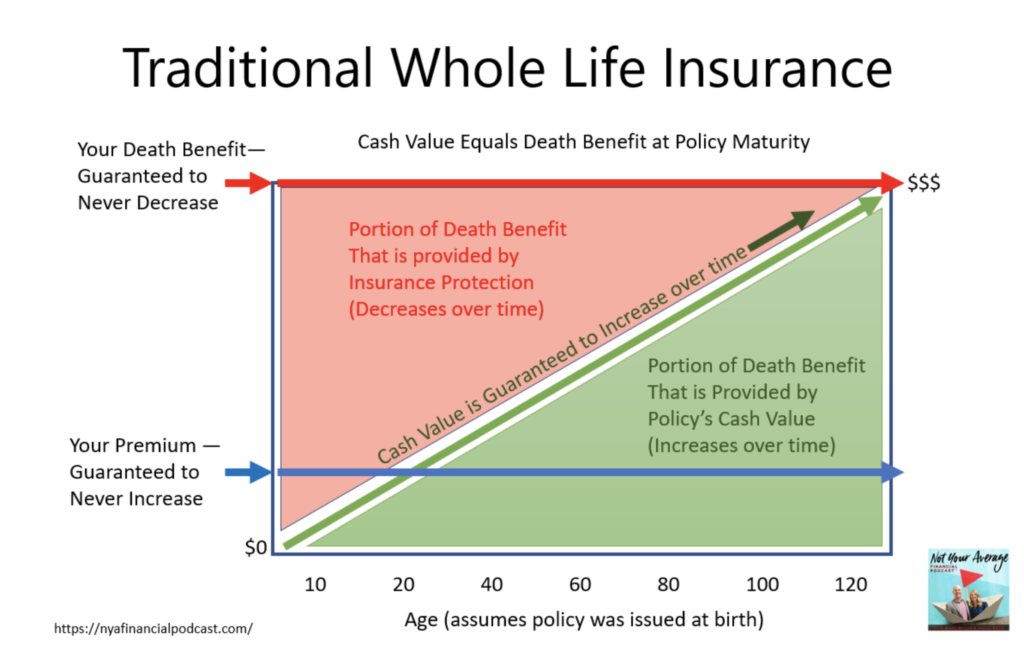

- What about when the cash value matches the death benefit?

- How is term insurance different?

- What about an example with old fashioned whole life insurance?

- Should I surrender a policy?

- …Do you feel lucky?

- Would you rather…?

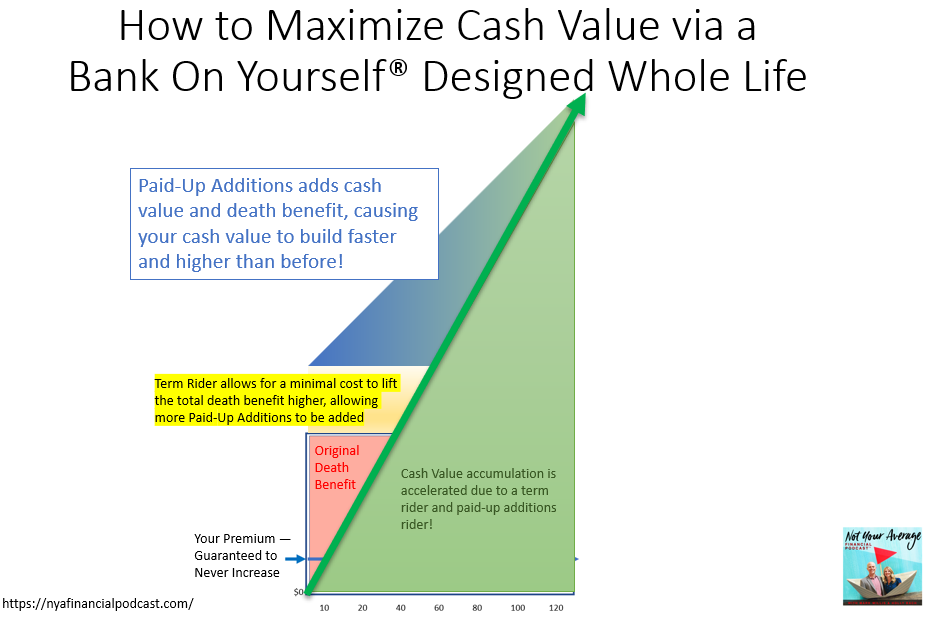

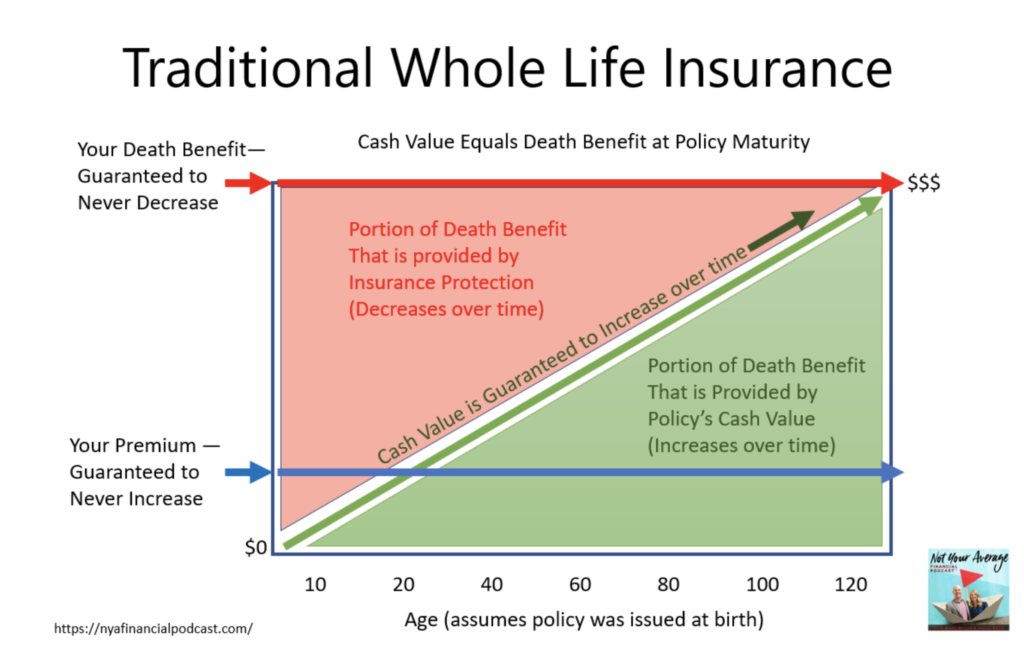

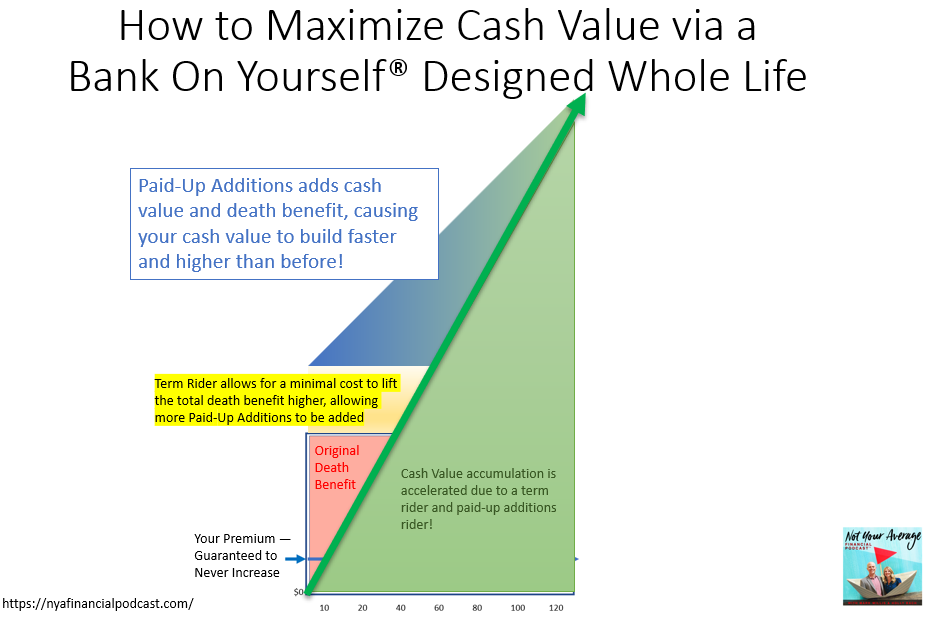

- What about an example with Bank on Yourself® type whole life insurance?

- What is growing?

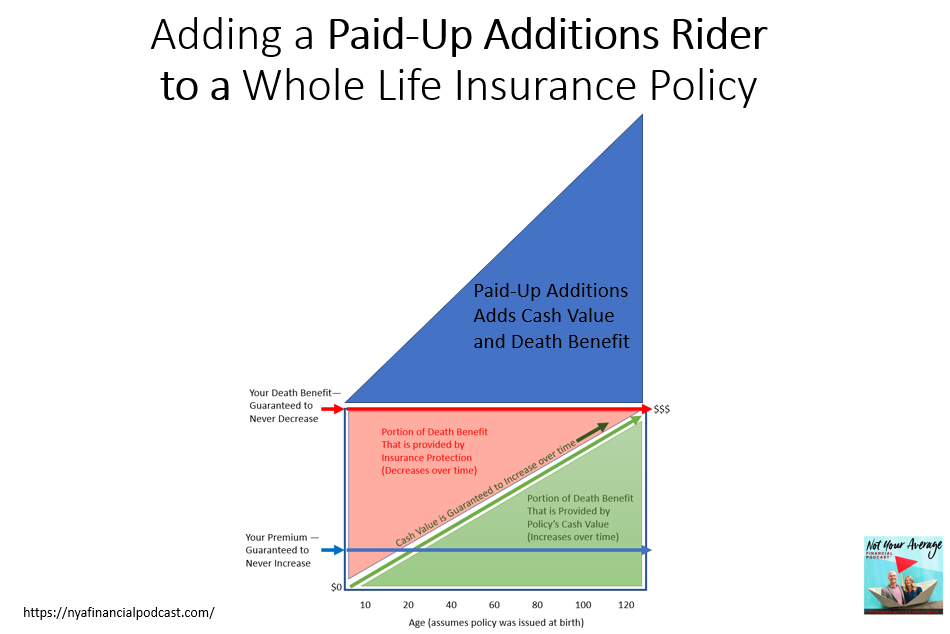

- How do PUAs change everything?

- What is ever increasing…?

- What are the implications?

- What else in the financial universe works this way?

- What about algae?

- What about the explosion of a supernova?

- What did Albert Einstein say?

- How is guaranteed growth possible?

- Would you like to listen to Episode 197?

- Are you forced to pay premiums forever?

- What if you can’t pay the premiums?

- Would you like to hear Episode 203?

- What is reduced paid up (RPU)?

- How does this work?

- What are the trade offs?

- How do different products work?

- How about an example?

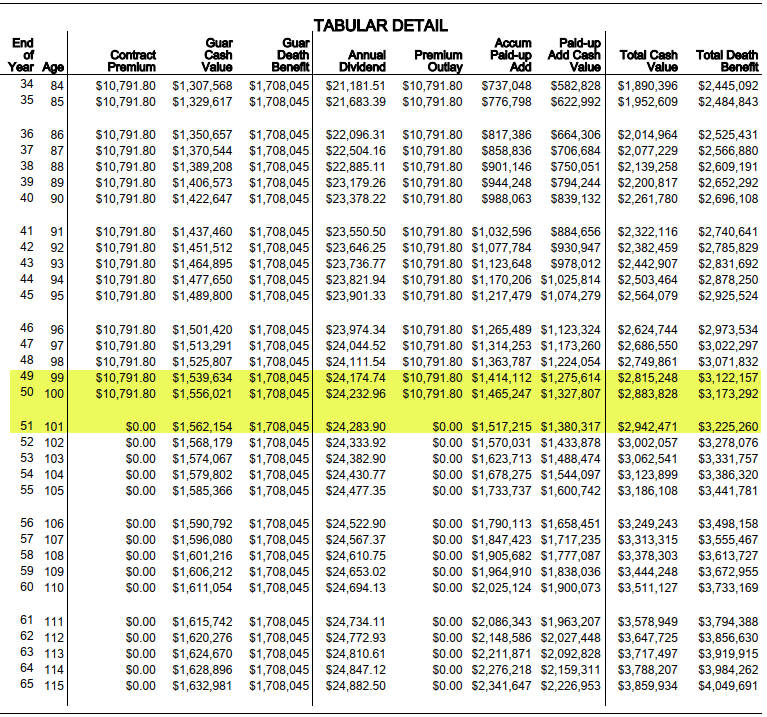

- What continues to grow, even after he stops paying premiums?

- What happens if he is still alive at age 121?

- What about funding a policy for only 10 years?

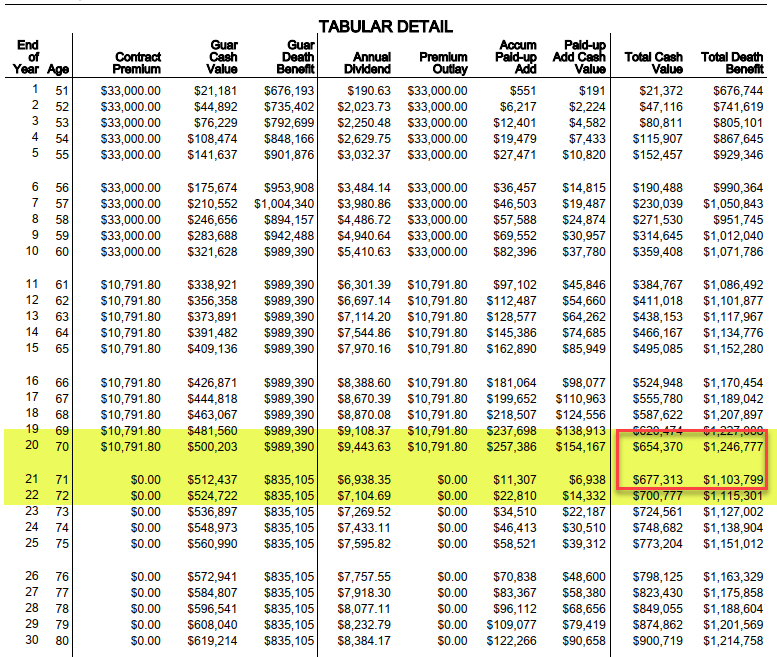

- What about retiring at age 70?

- What about reduce paying up at age 71?

- What will happen to the policy?

- What will the actuarial math do?

- What happens to the cash value?

- How can the cash value continue to increase after RPU?

- Who can RPU? What are the rules?

- What about another example?

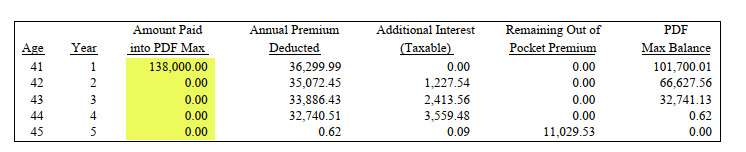

- Does this work with lump sums?

- What about a lifetime of tax free access to the cash?

- What happens if one reduce pays up after a policy loan gets out of hand?

- What about paying down a policy loan with cash flow freed up from RPU?

- What about the restrictions on universal life contracts?

- When will premiums need to stop?

- Can expenses ever stop?

- What are some of the other considerations of RPU?

- Would you like to meet with Mark?

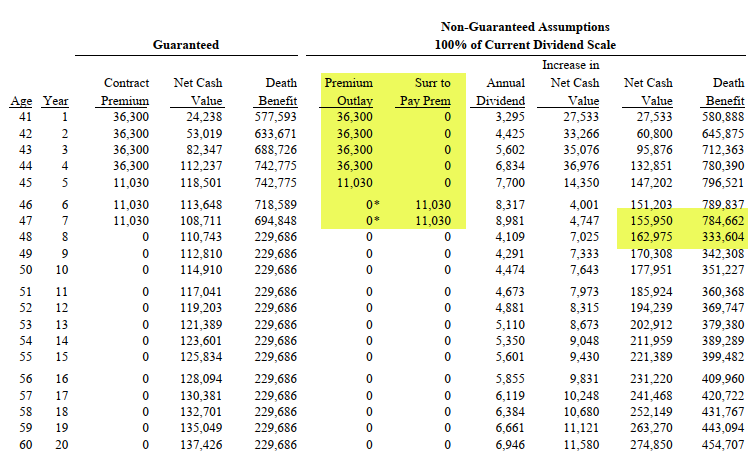

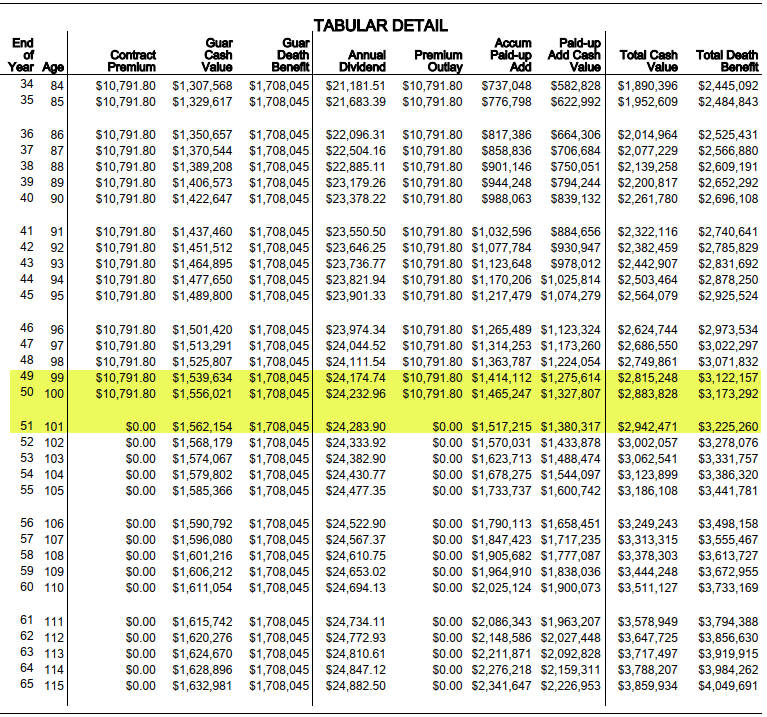

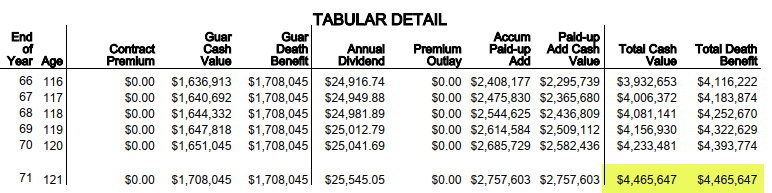

How Does Cash Value grow on a guaranteed basis? Follow along below:

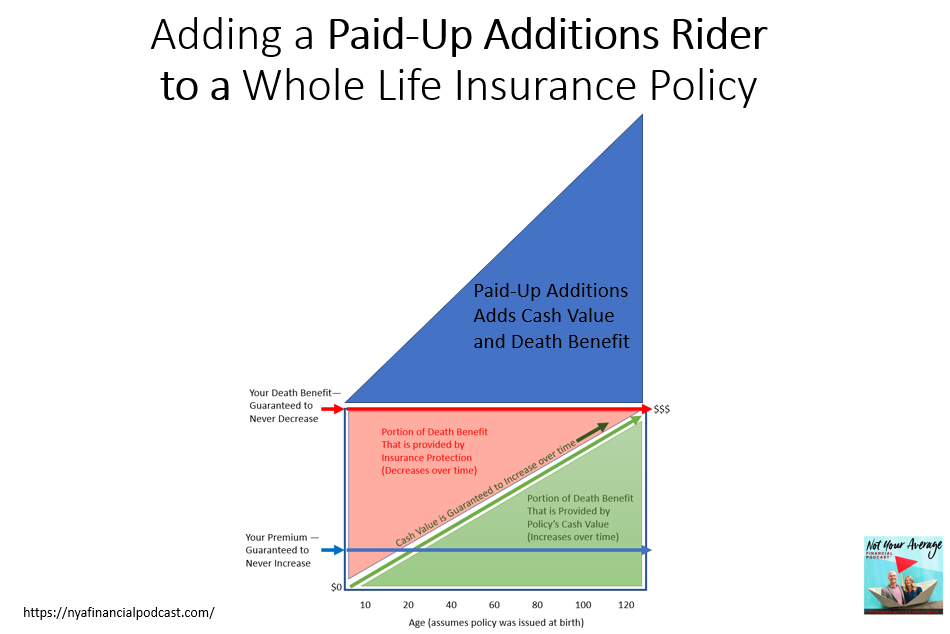

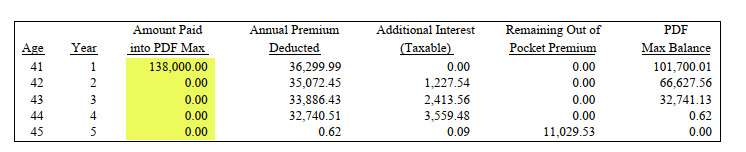

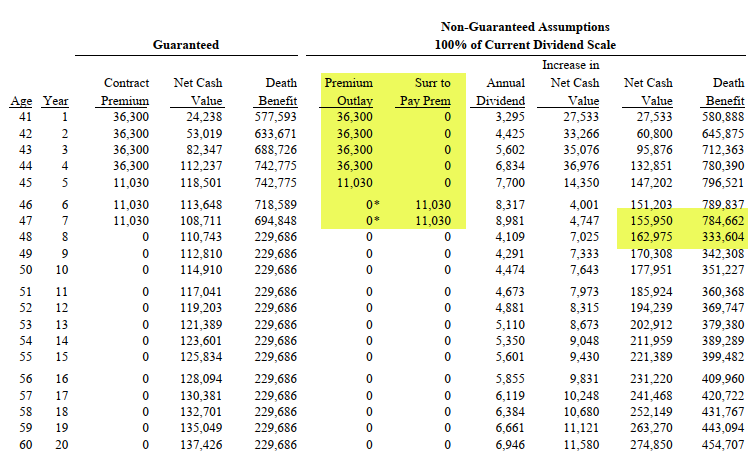

Pay One Lump Sum ($138,000)… funds it for 5 years!

Then in year 8 Reduce Pay Up and the cash value continues growing.

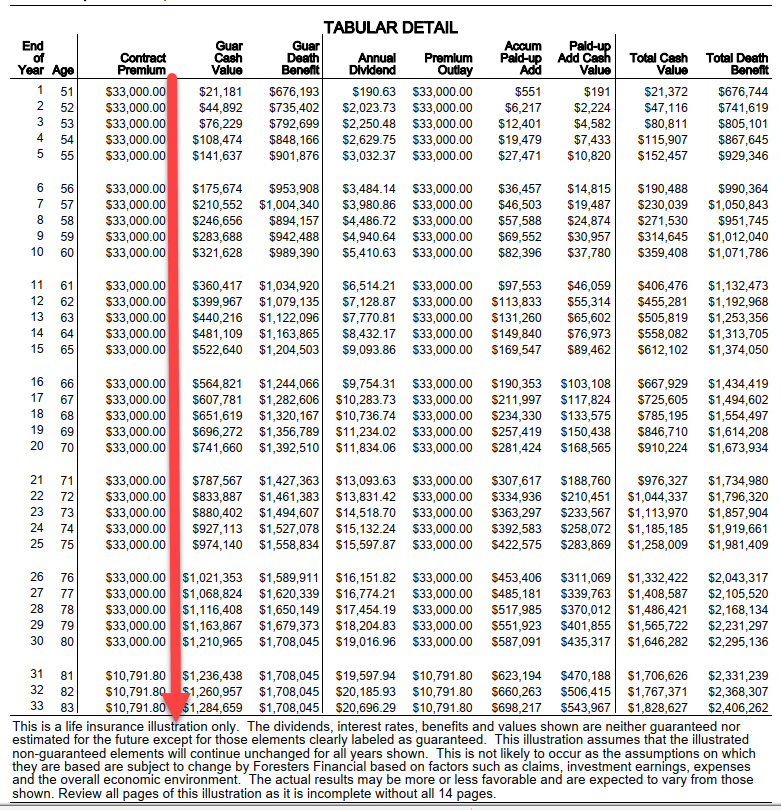

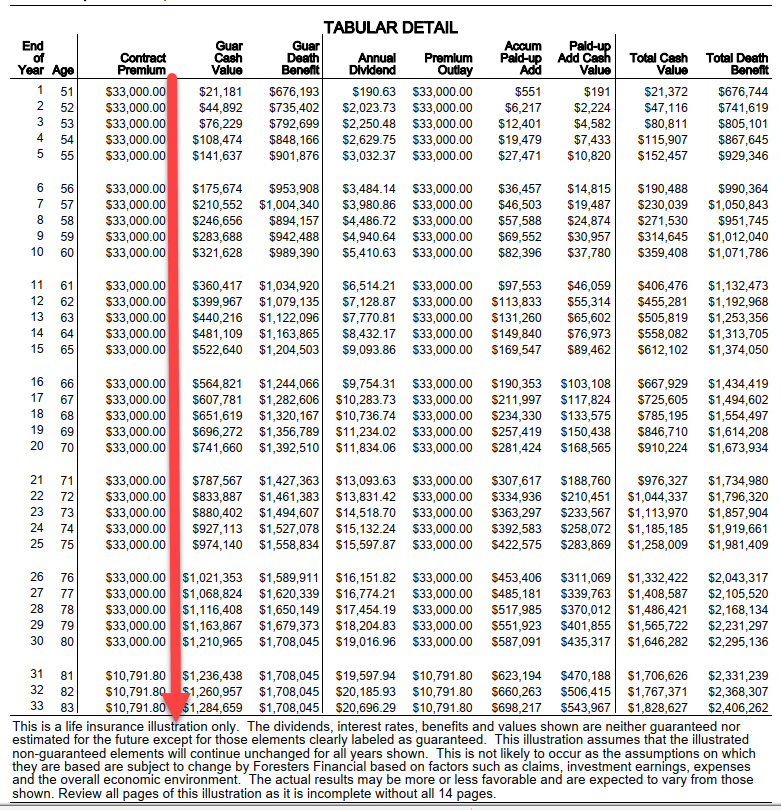

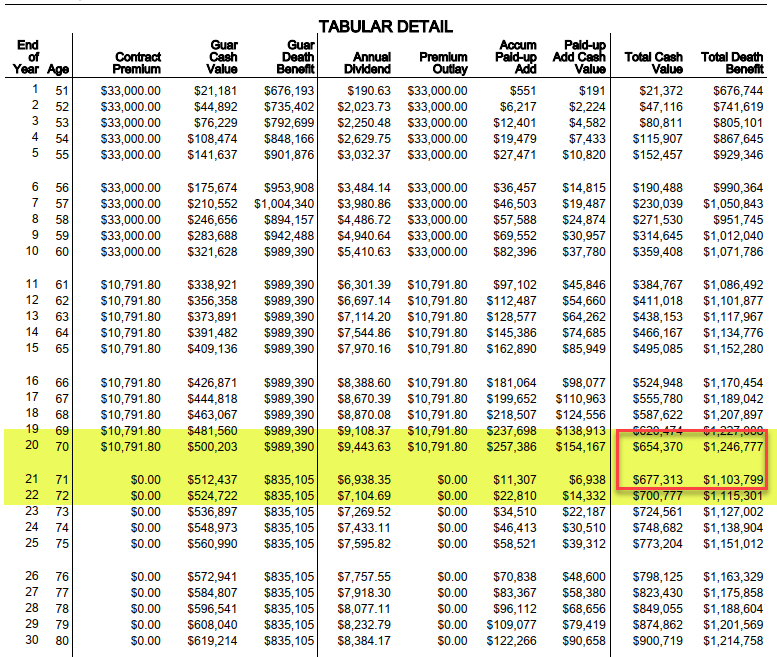

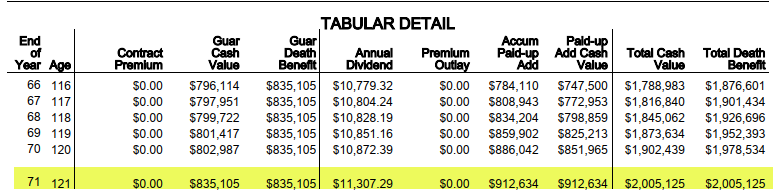

Of course, you might not want to fully fund this policy (as seen above for life) – instead you might follow this course of action: Fully fund the policy for 10 years then pay minimally until year 20, then reduce pay up your policy:

All guarantees are based on the claims-paying ability of the insurer. Dividends are not guaranteed.

These are not complete illustrations, but general information. They do not include the load costs or surrender charges which may or may not be included in the images above. All guarantees are based on the claims-paying ability of the insurer. Dividends are not guaranteed.

Please review a full contract and illustration for details when considering this for your situation.

334 episódios

Manage episode 370430947 series 1610796

In this episode, we ask:

- What is better than a five star review?

- Who needs to hear this?

- Would you like a FREE book? Email us at hello@nyafinancialpodcast.com!

- What about the Apollo missions?

- When will premiums come to an end?

- Would you like to hear Episode 293?

- What about the contractual obligation of the life insurance company?

- What is a maturity date?

- What limits exist?

- What about age 121?

- What about actuarial math?

- What about when the cash value matches the death benefit?

- How is term insurance different?

- What about an example with old fashioned whole life insurance?

- Should I surrender a policy?

- …Do you feel lucky?

- Would you rather…?

- What about an example with Bank on Yourself® type whole life insurance?

- What is growing?

- How do PUAs change everything?

- What is ever increasing…?

- What are the implications?

- What else in the financial universe works this way?

- What about algae?

- What about the explosion of a supernova?

- What did Albert Einstein say?

- How is guaranteed growth possible?

- Would you like to listen to Episode 197?

- Are you forced to pay premiums forever?

- What if you can’t pay the premiums?

- Would you like to hear Episode 203?

- What is reduced paid up (RPU)?

- How does this work?

- What are the trade offs?

- How do different products work?

- How about an example?

- What continues to grow, even after he stops paying premiums?

- What happens if he is still alive at age 121?

- What about funding a policy for only 10 years?

- What about retiring at age 70?

- What about reduce paying up at age 71?

- What will happen to the policy?

- What will the actuarial math do?

- What happens to the cash value?

- How can the cash value continue to increase after RPU?

- Who can RPU? What are the rules?

- What about another example?

- Does this work with lump sums?

- What about a lifetime of tax free access to the cash?

- What happens if one reduce pays up after a policy loan gets out of hand?

- What about paying down a policy loan with cash flow freed up from RPU?

- What about the restrictions on universal life contracts?

- When will premiums need to stop?

- Can expenses ever stop?

- What are some of the other considerations of RPU?

- Would you like to meet with Mark?

How Does Cash Value grow on a guaranteed basis? Follow along below:

Pay One Lump Sum ($138,000)… funds it for 5 years!

Then in year 8 Reduce Pay Up and the cash value continues growing.

Of course, you might not want to fully fund this policy (as seen above for life) – instead you might follow this course of action: Fully fund the policy for 10 years then pay minimally until year 20, then reduce pay up your policy:

All guarantees are based on the claims-paying ability of the insurer. Dividends are not guaranteed.

These are not complete illustrations, but general information. They do not include the load costs or surrender charges which may or may not be included in the images above. All guarantees are based on the claims-paying ability of the insurer. Dividends are not guaranteed.

Please review a full contract and illustration for details when considering this for your situation.

334 episódios

모든 에피소드

×Bem vindo ao Player FM!

O Player FM procura na web por podcasts de alta qualidade para você curtir agora mesmo. É o melhor app de podcast e funciona no Android, iPhone e web. Inscreva-se para sincronizar as assinaturas entre os dispositivos.